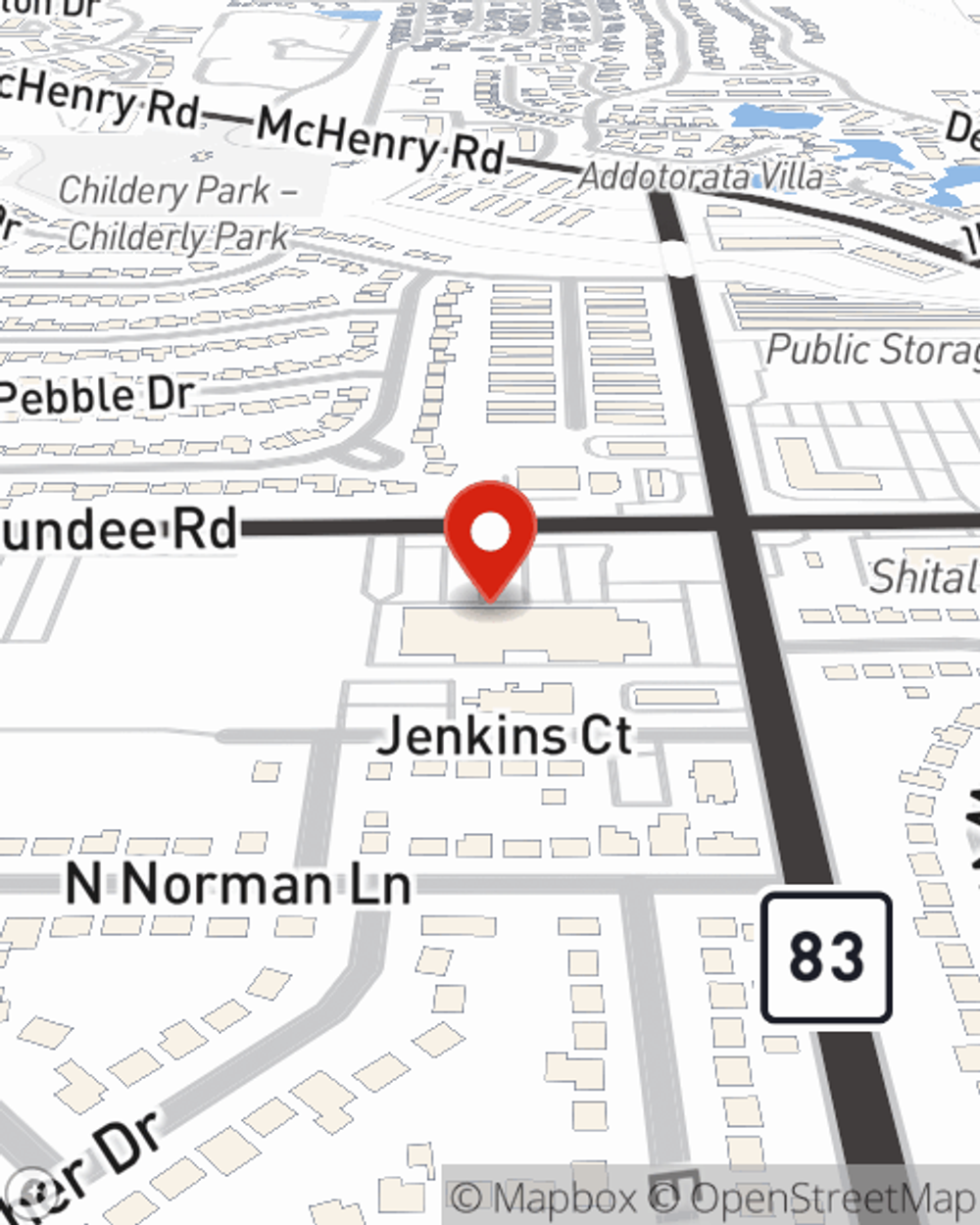

Renters Insurance in and around Wheeling

Welcome, home & apartment renters of Wheeling!

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Wheeling, IL

- Buffalo Grove, IL

- Mt Prospect, IL

- Prospect Heights, IL

- Palatine, IL

- Cook County, IL

- Lake County, IL

- Chicagoland

- Schaumburg, IL

Protecting What You Own In Your Rental Home

Your rented property is home. Since that is where you relax and kick your feet up, it can be advantageous to make sure you have renters insurance, even if you think you could afford to replace lost or damaged possessions. Even for stuff like your coffee maker, hiking shoes, fishing rods, etc., choosing the right coverage can insure your precious valuables.

Welcome, home & apartment renters of Wheeling!

Coverage for what's yours, in your rented home

There's No Place Like Home

Many renters don't realize that their landlord's insurance only covers the structure. Your valuables in your rented space include a wide variety of things like your bed, tool set, bicycle, and more. That's why renters insurance can be such a good decision. But don't worry, State Farm agent Veronica Roman has the dedication and efficiency needed to help you examine your needs and help you keep your belongings protected.

Reach out to Veronica Roman's office to explore the advantages of State Farm's renters insurance to help keep your personal property protected.

Have More Questions About Renters Insurance?

Call Veronica at (847) 537-5050 or visit our FAQ page.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Veronica Roman

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.